Covid-19 fast-forwarded the world and today, our world has become a hybrid one. Our updated lifestyles and experiences deeply influence our food and beverage priorities and behaviours.

When the pandemic first hit, the world was left exposed, prompting an immediate call for homemade immunity boosters. In Asia, interest in traditional recipes spiked sky-high.

Over time, our homebound lives created new habits. Some were good (healthier eating and self-care), some not so much (snacking up to 6X a day!). We started placing a stronger emphasis on mental well-being, including ways to destress and improve sleep.

As people return to offices, travel and larger gatherings in 2022, we’ll soon see which habits will stick and which will fade. As we recover, we also expect the conversation around sustainability to once again influence our food and beverage choices, likely with a larger focus on local ingredients and production.

This 30-page report digs into trends like:

- Turning to traditional ingredients and practices to boost immunity and gut health

- Turning to food to for better sleep and mental wellbeing

- Spike in demand for low-fat and low-sugar options

- Healthy ageing

- Tailoring plant-based to unique market preferences

- Convenience as a new key ingredient

Coverage: 5 key APAC markets

This report covers the five markets with the highest demand for food and beverage consumption trends.

- Collectively, the five markets analyzed represent 40% of the world’s population.

- The data covered beverages, snacks, dairy, and ready-to-eat.

- Data sources encompass social media, search data, recipe sharing forums and e-commerce product information.

- The food and beverage trends chosen represent either inflection or acceleration in existing demand.

China experiments with foods that support digestive and intestinal health

Over the last year, consumer interest in postbiotics in China hit a 4-year CAGR of +71% with no signs of slowing down. Foods and drinks associated with gut health have also been on a steady incline: oat milk reached 109% YoY growth.

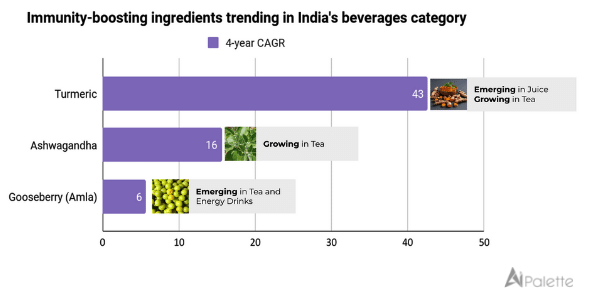

India reignites the use of spices, herbs, roots and fruits to boost immunity

Many in India have embraced natural ingredients and age-old remedies to strengthen their immunity. Turmeric is increasingly found in products like spiced turmeric latte powder, bumping up the superfood by 20% YoY in the teas and energy drinks categories. Indian gooseberry, or amla, is a staple in traditional Indian remedies, but a 7% CAGR over the last four years indicates that there’s still more headroom for this food and beverage consumption trend to grow.

Four ‘low’ food & beverage consumption trends that will continue high growth into 2022

From China’s nationwide ‘sugar reduction’ movement that continues to grow a decade since it launched, and low-calorie snacks in Japan (19% four-year rise in CAGR), to the growing popularity of low-carb snacks in Indonesia and low-fat snacks for the weight-conscious Thais, “less is more” is a growing trend that will grow in 2022 and beyond.

As people take better care of themselves, ageing healthily gains traction

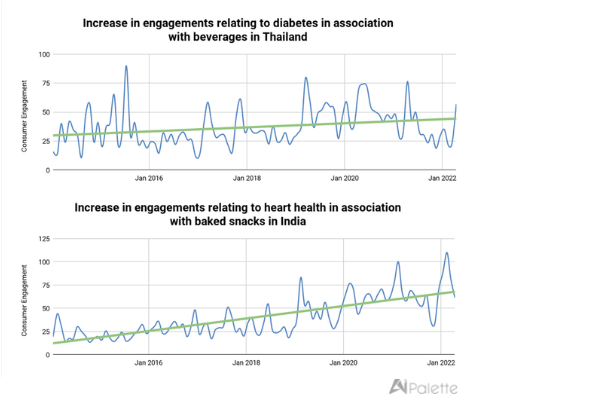

Priorities shifted during the pandemic, prompting many to take better care of themselves both mentally and physically. While every country faces concerns about heart health, diabetes and youthful looks, some specific food and beverage consumption trends have emerged as the ones to watch.

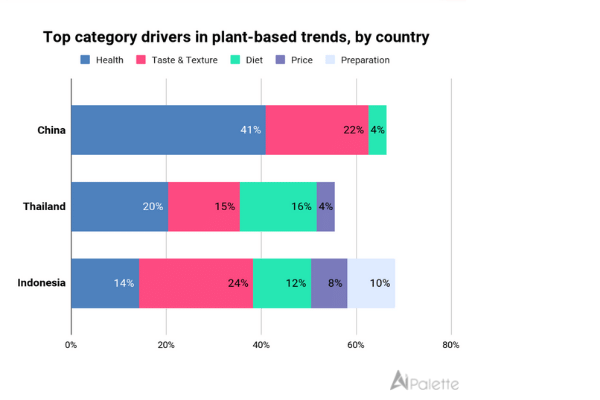

Localising to market preferences key to plant-based success

This year, we look at how localization is driving the maturity of the plant-based trend. Plant-based is not new in Asia but is seeing increased demand in restaurants and in retail. It is also linked to more uptake for veganism. Each market has a unique relationship with meat, so brands need to localize. For example, in Indonesia, product preparation (ie. halal foods) comes up as a consideration.

The 30-page report provides more charts, growth rates, and consumer verbatims on these trends. Download it here. You also get access to the on-demand webinar, where report co-author Salomi Naik explains the research and methodology.